We have established a

winning strategy in Web3

Investing simply with us in FIAT, is investing without complexity in the Web3 space, making the most of its potential with a balanced perspective

See More

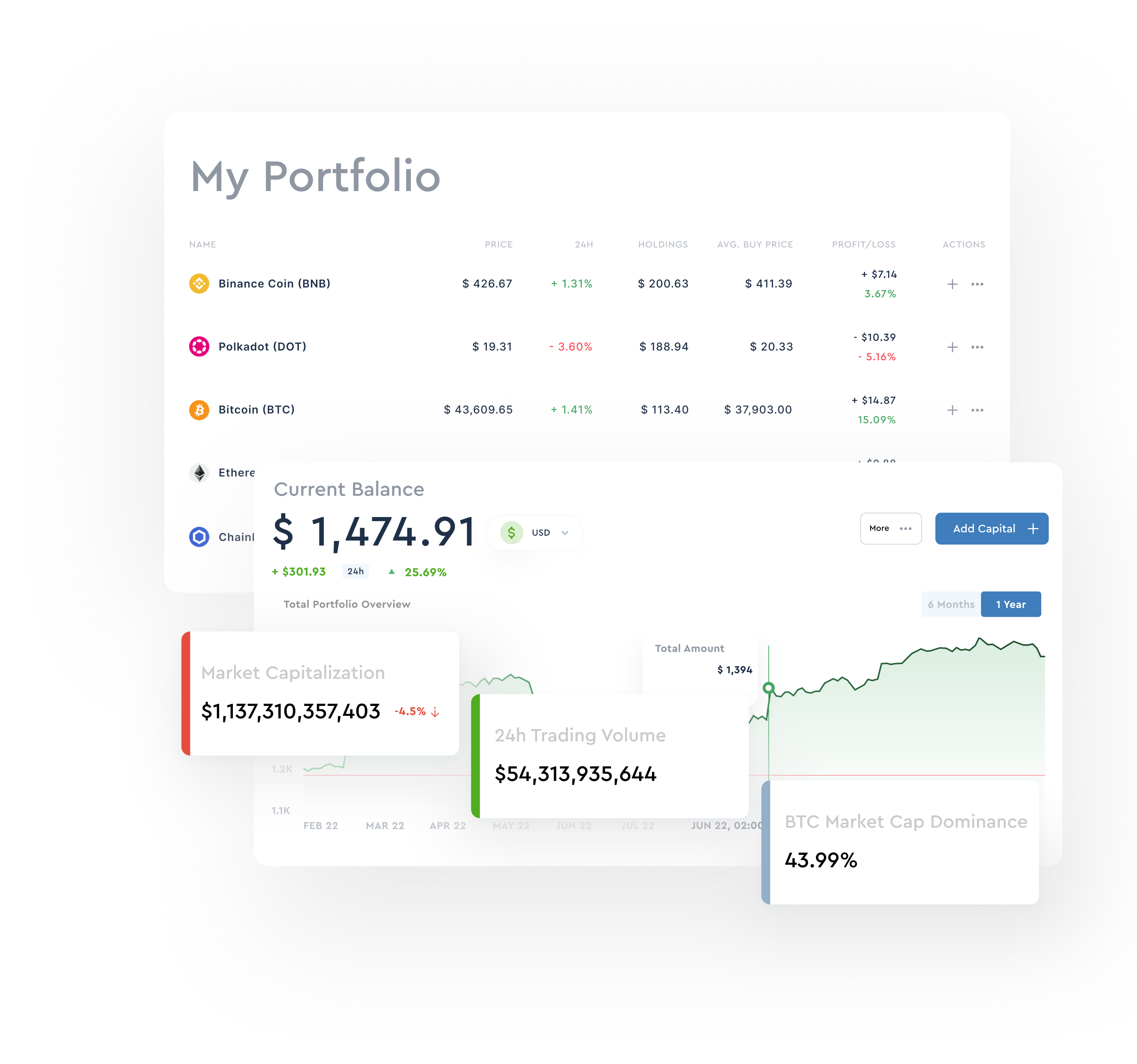

From Digital Assets to Web3 structured products

Discover our range of eligible Web3 products. Combining Bitcoin with risk mitigation, explore our stable coin solutions.

Personalised Investment Strategy

Select a personalized assortment of digital assets strategies that align with your preferences.

Commitment to Standards

Committed to maintain strict security. Including Risk Assessment Metrics for each counterpart we are operating with.

Comparison Chart

Features

Stable Growth Taking

TradeTogether Bitcoin Advantage Fund

SMA and Digital Bond Fund

| Features | Stable Growth Staking | TradeTogether Bitcoin Advantage Fund | Web3 Structured products |

|---|---|---|---|

| Risk Appetite level | Conservative | Conservative to Balance | Aggressive |

| Locking period | No Locking period | 3 Months | 3 to 9 Months |

| Targeted Net Yields | 8 to 13% | Based on Market trend | Based on Market trend |

| Minimum Investment | 5000 SGD | 5000 SGD | 5000 SGD |

We’re thrilled to offer you a web3 Fund vehicle On Demand, also called ‘Separated Managed account’ (SMA). Our expertise allows us to assess new types of digital assets or projects, ranging from utility tokens to Web3 structured products.

Comparison Chart

Stable Growth Staking

Risk Appetite level:Low risk

Locking Period:No Locking Period

Targeted Net Yields:5.5 to 8%

Minimum Investment:5000 SGD

TradeTogether Bitcoin Advantage Fund

Risk Appetite level:Low to medium risk

Targeted Net Yields:3 Months

Token Basket:Subject to upside

Minimum Investment:5000 SGD

Tokenized Bond,Impact RWA,Green Bonds

Risk Appetite level:Low to medium risk

Targeted Net Yields:3 to 9 months

Token Basket:8 to 14%

Minimum Investment:5000 SGD

We’re thrilled to offer you a web3 Fund vehicle On Demand also called ‘’Separated Managed account’’ SMA. Our expertise allows us to assess new types of Digital Assets or projects, ranging from Utility tokens, Tokenized Bonds and Web3 Impact investment projects.

Products

Stable Growth Staking

Our Benchmark Fund vehicle operating as the first of its kind Web3 Fixed income fund since 2021. Invested at 100% with Qualitative Stablecoins, risk assessed and traceable yield.

TradeTogether Bitcoin Advantage Fund

The Fund seeks exposure to BTC price movement while prioritizing risk-managed growth and potential upside appreciation. Supported by renowned crypto asset custodians, it offers a reliable and accessible investment avenue.

Web3 Structured products

This category offers a range of web3 solutions tailored for investors looking to diversify their portfolio with tokenized assets and innovative digital asset opportunities.

Fees

Transparency is our core value

Fees to actively optimise your portfolio

Blockchain fees for placing your capital

Web3 Risk Assessment and Project guidance

Fee-taking only on the profit generated

Frequently Asked Questions

Everything you need to know about the TradeTogether

Tailored to your

risk appetite

You don’t have to choose just one fund. We can tailor a specific allocation of your capital across our Web3 Fund solutions. Based on your goals and risk profile, we will recommend a bespoke investment approach.

Safety First

We apply the same strict security standards as tier-1 regulated banks, equivalent to ISO/IEC 27001.

Assets segregated with tiers 1 Custody solutions.

On/off Ramp enabled with tiers 1 Regulated Banks.

Transparent fee application

KYC Implementation with reputable trusted partners

Join a new generation of investors

Get Started On TradeTogether

Empower your Wealth strategy – be part of the TradeTogether investor community!

View Full Chart On Web

View Full Chart On Web